Man Noticed $35,000 Drained From His Bank Account, Chase Calls it a “Societal Problem” and Refuses to Help

Could Chase Bank be susceptible to bank account fraud? A recent customer account published in The Sun could confirm a degree of compromise.

Unfortunately, the customer had had $35,000 dollars removed from his account, prompting him to call customer service. He was told that no refund would be issued. Here’s what we know.

The “Blame Game” — Where Does the Fault Lie?

A recent story published via WXYZ Detroit noted that Chase has gone on record placing fault on the part of the customer, as the bank chain has stated that customers aren’t doing enough to secure their accounts.

Source: Canva/Pinterest

Data cited by The Motley Fool notes that about 11,000 American citizens reported bank account fraud in 2022 alone. Additionally, debit card fraud rates grew by 12%.

Authorized or Non-Authorized?

Per information sourced by The Sun, JP Morgan & Chase has noted that the victims affected by the fraud had appeared to have authorized the transfers, making their role in the resolution minimal.

Source: Canva

Victims claim that they have not authorized the transfers — and have gone to local news outlets with their story. WXYZ and The Sun are the first of many to tell their stories.

The Case of Bill Brown Jr.

Bill Brown Jr. was one of the Chase bank customers that had been affected by the fraud. He went to WXYZ and gave an interview about his experience.

Source: YouTube

“I’m at a loss..I’ve been very…upset for a year, to…where sometimes I think I might be having a heart attack.”

$35,000 Lost, Call if Found

Bill Brown’s story began when he found $35,000 mysteriously gone from his account. He specified that it had been a Chase Home Equity Line of Credit account.

Source: Canva/Wikitubia

The money had been taken in February. Nothing had happened out of the ordinary, beyond an odd spam call about his computer being hacked. No personal information was shared at the time of the call.

Give An Inch, Take a Mile

Despite the fact that no personal information was shared, Bill Brown had become a victim of account fraud. As soon as he noticed the funds gone, he went to Chase to explore his options.

Source: Reddit

Chase told the customer that they would not be able to refund him. The reason? They determined that he didn’t take enough steps to protect his computer or his personal information.

Left Adrift: Bill’s Next Steps

“I don’t know what other steps anyone could take to provide their information (in this case),” Brown told reporters at WXYZ.

Source: LED Equipped

After the bank denied his request for a refund or for further assistance, Brown sought support from his local police station due to the amount of money taken. Grosse Pointe Woods Police staff went on record to note that it was a significant amount of money lost.

Scam or No Scam? The Jury’s Still Out

In an interview conducted by WXYZ staff, Detective Miles Adams notes that the primary problem with this type of fraud is that it’s difficult to recoup the transfer once it’s occurred.

Source: Canva

He also noted that complicated hacking methods, such as phone spoofing, can complicate the problem — as it’s not clear what really happened in many cases.

The Case of Amber — Chase’s Second Disgruntled Customer

Unfortunately, Bill Brown’s experience isn’t unique when it comes to account fraud and JP Morgan & Chase’s resolution system. A second client came forward to WXYZ about her experiences, choosing to identify as “Amber.”

Source: Reddit/Canva

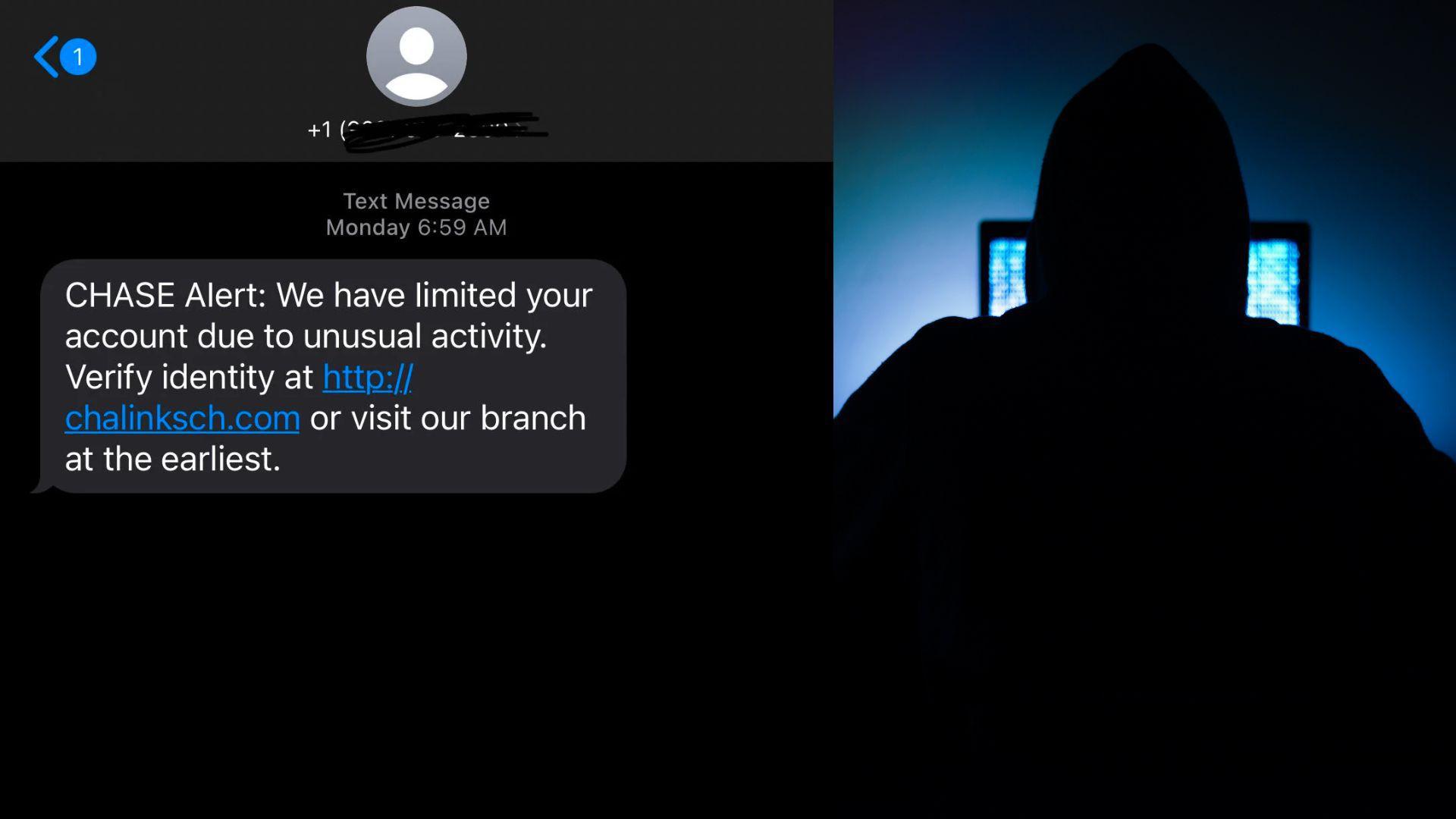

Amber had just conducted business at her local branch when she got a text on her phone about fraud related to her account.

Amber’s Next Steps

After getting the text message, Amber called Chase in the text message to notify them about what had happened. She carefully went through the prompts, receiving a second call as she did so — from a spoofed Chase phone line.

Source: Reddit/Canva

“They (the hackers) knew (everything about me). They said to secure the account, we have to move your money.”

Major Losses, Major Lessons

Following their recommendations, Amber erroneously transferred $17,500 to the scammer without realizing she had been conned. After the realization, she asked Chase for help, requesting that they stop the transfer.

Source: PYMNTS.com

“He said it’s not on us (Chase) to stop it, which I find weird,” Amber said. “It’s just very frustrating that they don’t care, and they just let these people get away with it…” Amber continued to WXYZ.

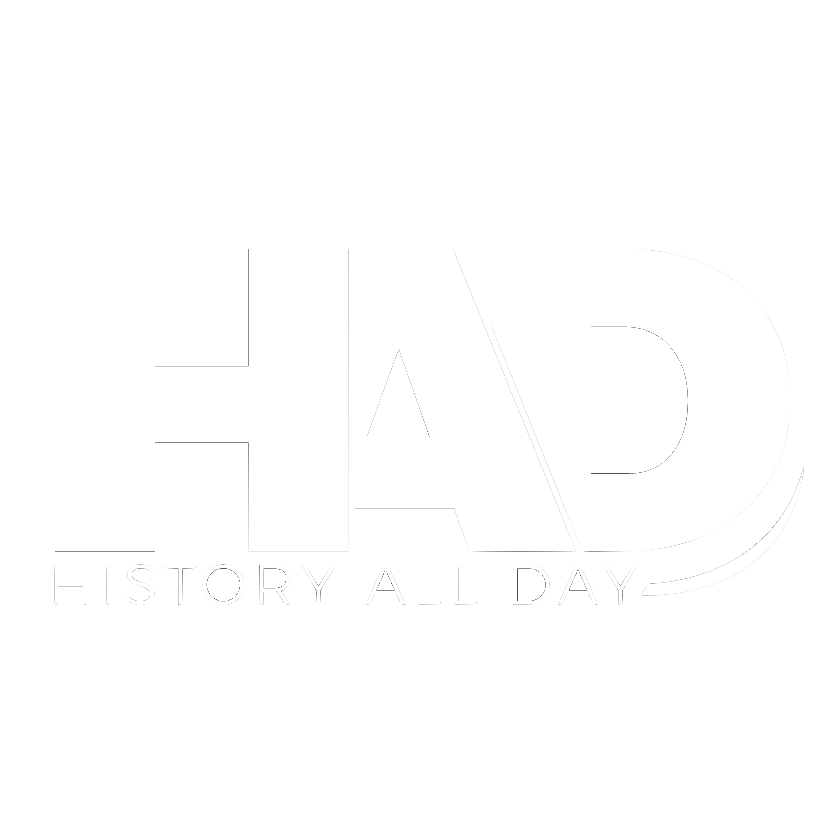

How Do I Stay Safe?

These accounts prompt many to wonder — how do I keep my assets and interests safe from account fraud?

Source: LinkedIn

Detective Miles Adams went on record with prevention tips in a quote to WXYZ, advising consumers to conduct all business and bank matters in person to minimize risk.